Recoverable Depreciation vs. Non Recoverable Depreciation

Understanding the difference between recoverable and non-recoverable depreciation can be complicated, especially for a property owner without a public adjuster on their side. However, it’s an essential part of the insurance claim process.

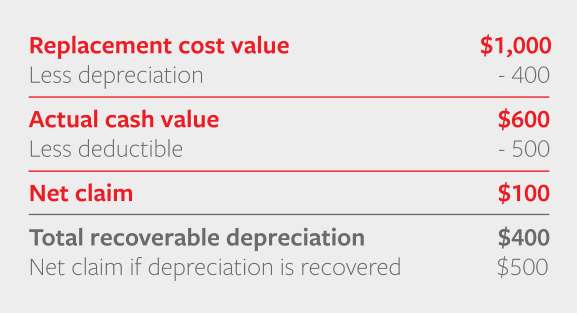

Recoverable cost value (RCV) is what an insurance company believes the worth of damaged items or parts of a property to be prior to the damage occurring. Depreciation is the decrease in value over time and actual cost value is RCV minus the depreciation of those items.

Recoverable depreciation is money received from an insurance claim for items that have depreciated over time. Non-recoverable depreciation, conversely, is the depreciation that won’t be paid out by an insurance company. Some policies include replacement cost coverage, so you may still be able to receive payments for lost contents or property.

If you want to ensure you get the most out of your settlement and make the claims process easier, hiring a public adjuster can help you. They’ll guide you through every step of the process, maximize your claim payout, and explain any confusing terms.

What is Insurance Depreciation?

Depreciation is an important factor to consider when filing an insurance claim. By definition, depreciation occurs over time and is the difference between what you initially paid for a property and its current appraised value. When it comes to insurance claims, it is essential to accurately assess depreciation in order to ensure full compensation for any damage caused to your home.

Insurance companies may not have the most up-to-date information and their appraisal of self-acquired items may be lower than what you originally paid. As such, it is important to properly calculate depreciation in order to get a fair and accurate settlement from the insurance company.

What Does Recoverable Depreciation Mean?

Recoverable depreciation is the amount of money you can recover from an insurance claim for an item that has depreciated in value over time. For example, if you bought a dishwasher three years ago for $800 and it was damaged by a fire and could not be cleaned, its worth today may only be $500 due to depreciation. In this case, your recoverable depreciation would be $500 – the difference between what you paid for it originally and what its current market value is. Understanding the concept of recoverable depreciation is essential for ensuring that you receive the full compensation you are entitled to after a loss.

When it comes to evaluating depreciation, the replacement cost and useful life of an item are key factors. Take for example a TV damaged in a storm two years after its purchase. Assuming the same brand and model still sells in stores for $1,000 and lasts five years, or has a 20% depreciation annually, the actual cash value of that TV would be $800. The total recoverable depreciation would be $200. By taking into account these two components, one can easily calculate the depreciation of any item.

Non-Recoverable Depreciation

Non-recoverable depreciation is an expense that an individual or business is unable to recoup in the event of a loss. To illustrate, if a dishwasher were to be damaged beyond repair, the initial cost of the unit minus its depreciated value ($300 in our example) would not be refunded due to the non-recoverable nature of depreciation. As such, businesses and individuals should make extra effort to ensure they are informed of their various assets’ depreciation rates to plan accordingly for any potential losses.

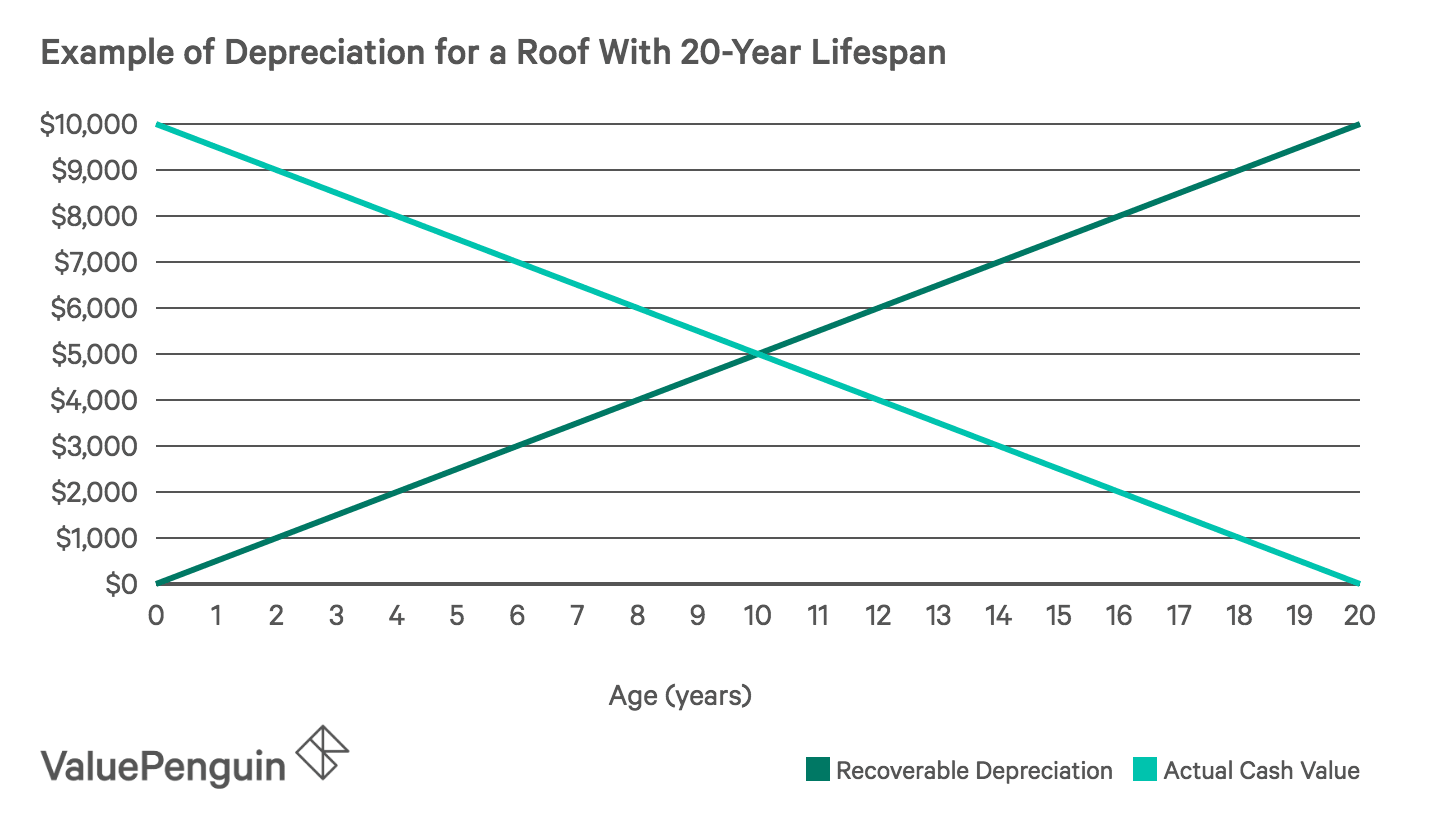

If your roof has sustained hail damage and must be replaced, understanding the depreciation value is essential in order to receive a fair payout from your insurance company.

Most roofs have a “useful life” of 20 years and are depreciated by 5% per year from the purchase date.

That means if your roof is 10 years old when it incurs damage, it will have already depreciated by 50%, reducing its actual cash value to $6,000 (assuming you had originally paid $12,000 for it). A non-recoverable policy won’t reimburse the additional amount in depreciation costs; insurance will only cover the actual cash value of $6,000. That other $6,000 is considered to be the non-recoverable depreciation amount.

If you’ve recently experienced a loss and are feeling frustrated by non-recoverable depreciation, it’s worth assessing your insurance policy to determine what coverage options you have. Many policies offer replacement cost coverage where you can be compensated for your belongings without any depreciation involved – however, this is often an additional charge. We highly advise considering this option if you own expensive electronics or other valuables, as not having such protection could leave you substantially out-of-pocket. Talk to your insurer today to find out more about securing compensation at the replacement cost value!

ACV – Actual Cost Value

The actual cost value of an item is the amount you can expect to recover from it after taking depreciation into account. Knowing the actual cost value of your possessions is a key part of maintaining their worth and keeping your assets up to date. By understanding how much these items are really worth, you can make more informed decisions about when to repair or replace them, helping you keep your finances in order over time.

Homeowners’ insurance policies are designed to cover the cost of replacing damaged or lost items. However, they do not always provide reimbursement for the actual cost of replacing the item with a new one. Instead, they may offer reimbursements based on a measure known as the ‘actual cash value’ (ACV) of the property.

ACV is calculated by subtracting an item’s depreciation from its replacement cost. This means that the insured property may not be replaced with a new item, but rather with one which has been previously owned or used. Although ACV may be lower than the original replacement cost, it is still an important tool in helping policyholders recoup some of their costs following damage or loss to their property.

Recoverable Depreciation Claims

Making a recoverable depreciation claim can sometimes be a tricky process, but with the right guidance, it can be made easier.

- Notify your insurance provider promptly of any damage that has occurred to an item in order for them to evaluate the cost of repair or replacement.

- Gather all necessary receipts and photographs as evidence of ownership, as well as any police reports if the claim is a result of theft.

- Submit your claim form and any other relevant documentation to the insurance company, and wait while they review and make their assessment.

- You’ll receive a payment for the item’s actual cash value according to the insurer’s evaluation, then repair or replace the item once you receive the funds.

- Submit the receipts to your insurance provider and you will then be issued another payment that covers the cost of recoverable depreciation.

If you disagree with your insurer’s assessment, you may negotiate the value of your recoverable depreciation check, and can even ask for a line-item breakdown of values rather than a lump sum to better understand how your item has been valued.

Home furnishings, electronics, and appliances are some of the most commonly evaluated items when making this type of claim.

FAQs on Insurance Depreciation

How does depreciation work on an insurance claim?

Depreciation is a concept used in insurance to recover some or all of the cost associated with replacing lost or damaged property. Generally, it is an estimate of how much the replacement value of your item has decreased due to age and normal wear and tear. When you claim depreciation, you will be compensated for the amount by which your replacement cost has depreciated from its original value.

How long do I have to claim recoverable depreciation?

You typically have up to one year from the date of the loss to file a claim for recoverable depreciation. Make sure you keep track of important paperwork and documents such as receipts and invoices as these may help when filing a claim for depreciation.

Can you get back non-recoverable depreciation?

Unfortunately, it is not possible to get back non-recoverable depreciation as this amount has already been calculated and taken into consideration at the time of the initial claim. Non-recoverable depreciation is the amount of money that is not refunded as part of an insurance claim due to factors like depreciation, obsolescence, etc.

How do I get recoverable depreciation back for roof replacement?

To receive recoverable depreciation for roof replacement, you must first submit a detailed estimate of the roof’s replacement cost to your insurance company. Once the estimate is approved, your insurer will then determine the amount of recoverable depreciation and issue payment accordingly. Depending on the insurance policy, recovery may also include other factors such as labor costs or taxes.

Does recoverable depreciation go to the homeowner?

Yes, recoverable depreciation usually goes directly to the homeowner or policyholder who made the claim. However, any applicable taxes or fees may be deducted from the total amount before payment is issued. It is important to check with your insurance carrier prior to submitting a claim for depreciation to ensure full understanding of the process.

What happens if you forget to claim depreciation?

If you forget to claim depreciation, you are likely to miss out on a portion of the insurance settlement, depending on your policy agreement. Therefore, it is important to carefully review any documents related to your insurance claim in order to ensure that nothing important was overlooked.

Can you choose not to claim depreciation?

Yes, you can choose not to claim depreciation if you do not need immediate funds for repair or replacement costs. However, it is important to discuss this decision with your insurance carrier so that you fully understand all of the consequences involved.

Do you get depreciation back from insurance?

Yes, some policies will provide a portion or even all of the non-recoverable depreciation as part of a settlement. In order to determine whether or not your policy includes such a provision, be sure to read through all documents related to your insurance policy prior to making a claim.

Can you backdate depreciation?

No, typically it is not possible to backdate depreciation on an insurance claim. The amount of recoverable depreciation must be determined at the date of the loss and cannot be changed retroactively.

How to Know if an Insurance Company Underpays Your Claim

If you’re looking to receive a fair insurance settlement without the hassle and stress that can accompany the process, consider engaging an expert in property damage claims. Our team of highly-trained professionals has extensive experience in helping clients receive the maximum compensation for their property damage insurance claims.

We offer free consultations with no strings attached so you can get your claim on track quickly and easily. Our expertise gives us an edge when it comes to navigating the complexities of the insurance system, so you don’t have to worry about unfamiliar terms or difficult procedures. Get the most out of your insurance claim by enlisting the help of experts who have your best interests at heart.